A Missed Punch Without An Attendance App Becomes a Payroll Crisis

Why Need An Attendance App? It usually starts with a message on the 30th of the month.

“Why is my salary short?”

For Indian HR teams, this question no longer triggers mild anxiety — it triggers a full-blown investigation. Attendance logs are pulled. Shift rules are rechecked. Excel sheets are reopened. Managers are looped in. Payroll deadlines inch closer.

In 2025, this situation isn’t caused by lazy employees or careless HR teams. It’s caused by something far more common: an attendance app that isn’t payroll-ready.

As Indian workplaces shift toward hybrid models, remote field staff, and flexible hours, the gap between attendance tracking and payroll accuracy has become dangerously wide. A basic self-attendance app might capture clock-ins — but can it actually power payroll without manual intervention?

That’s the question HR leaders must ask this year.

Why Payroll-Readiness Is the Real Test of an Attendance App in 2025

For years, attendance apps were judged on one simple metric:

“Does it mark attendance?”

In today’s Indian HR landscape, that metric is outdated.

Payroll in India is tightly connected to statutory compliance, wage structures, leave laws, overtime rules, and audit trails. According to the Ministry of Labour and Employment, inaccurate wage computation remains one of the most common causes of labour disputes in India.

An attendance app that doesn’t align with payroll realities creates downstream chaos — not efficiency.

In 2025, payroll-readiness means something far deeper.

The Indian HR Reality: Attendance Is No Longer Just About Office Entry

The Rise of Self Attendance Apps — and Their Hidden Gaps

Self attendance apps exploded in India post-pandemic. Employees check in from home, construction sites, retail outlets, and client locations. Facial recognition, GPS tagging, and mobile logins became the norm.

But here’s the catch:

Most self attendance apps were built for visibility, not salary computation.

They show who worked. Payroll needs to know how work translates into pay.

That difference is where most systems fail.

What Indian HR Teams Must Check Before Trusting an Attendance App for Payroll

1. Can the Attendance App Handle India’s Complex Pay Structures?

Indian payroll isn’t flat-rate. It includes:

- Basic pay

- HRA

- Variable allowances

- Overtime

- Late deductions

- Shift differentials

If your attendance app only records total hours without mapping them to pay components, HR is forced back into spreadsheets.

A payroll-ready attendance app must convert attendance data into salary-impacting inputs automatically.

2. Does It Align with Indian Labour Laws and Wage Codes?

With the gradual implementation of the new Labour Codes, attendance data now influences:

- Overtime eligibility

- Daily vs weekly work hour limits

- Leave accrual logic

According to official labour code drafts and state notifications, inaccurate time tracking can directly affect statutory wage compliance.

If your attendance app doesn’t allow rule-based configurations aligned with Indian labour laws, payroll risk increases every month.

3. Is Leave Truly Integrated — or Just Visually Linked?

Many attendance apps show leave records. Very few calculate payroll impact correctly.

A payroll-ready system must automatically adjust:

- Paid vs unpaid leave

- LOP deductions

- Carry-forward policies

- Holiday overlaps

When leave and attendance live in separate systems, HR ends up reconciling manually — defeating automation.

4. Can It Handle Exceptions Without Manual Overrides?

Real Indian workplaces are messy.

Employees forget to punch. Internet drops. Managers approve late entries retroactively.

If your attendance app pushes these exceptions into payroll without approval workflows, salary errors are inevitable.

Payroll-readiness means:

- Manager validation flows

- Audit logs

- Cut-off controls before payroll runs

Anything less creates compliance and trust issues.

A Silent Payroll Killer: Attendance Data That Can’t Be Audited

In India, payroll audits aren’t hypothetical. They happen during:

- Labour inspections

- PF and ESIC checks

- Internal finance audits

An attendance app must maintain tamper-proof logs that show who edited what — and when.

Without audit trails, attendance data becomes legally fragile.

Why Indian Finance Teams Now Care Deeply About Attendance Apps

Earlier, attendance apps were “HR tools.”

In 2025, CFOs are paying attention.

Why?

Because payroll errors directly affect:

- Cash flow planning

- Compliance penalties

- Employee attrition

According to multiple industry payroll studies, even small payroll inaccuracies significantly reduce employee trust — especially in mid-sized Indian companies.

A payroll-ready attendance app is now a financial control system, not just an HR feature.

Where DigiSME HRMS Changes the Game

This is where DigiSME HRMS approaches attendance differently.

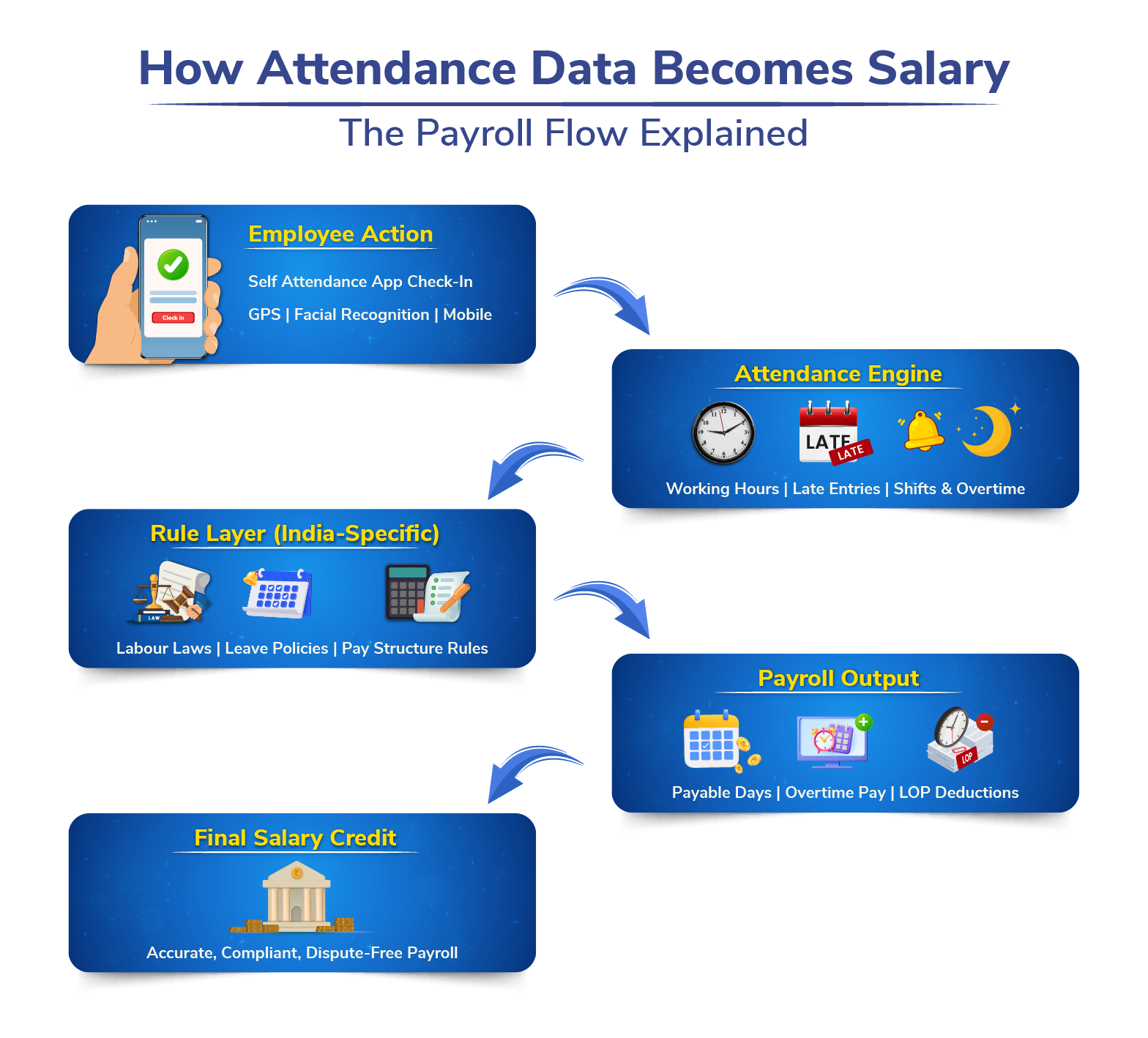

Instead of treating attendance as a standalone feature, DigiSME designs it as a payroll input engine.

Attendance, leave, shift rules, and payroll calculations live in one connected system — reducing reconciliation effort and human error.

For teams already exploring integrated HR solutions, you may want to also read:

→ How Cloud-Based HRMS Is Reshaping Payroll Accuracy in India

This perspectives connect directly to why payroll-readiness is no longer optional.

| An attendance app is payroll-ready when it converts attendance data directly into salary calculations without manual intervention. Indian HR teams must ensure attendance systems comply with labour laws, leave rules, and payroll audit requirements. A self attendance app without payroll integration increases salary errors and compliance risks. |

Conclusion: Payroll Accuracy Starts Long Before Salary Day

In 2025, Indian HR teams can no longer afford to ask whether their attendance app works.

The real question is:

Does it protect payroll accuracy, compliance, and employee trust?

A modern attendance app or self-attendance app must do more than record time. It must translate work into wages — accurately, transparently, and legally.

That’s the difference between a tool that tracks attendance and a system that powers growth.

If your organisation is re-evaluating this gap, now is the right time to look deeper — before the next payroll cycle exposes it.

Contact Us For A Free Demo!!

Frequently Asked Questions

What does payroll-ready mean for an attendance app?

A payroll-ready attendance app automatically converts attendance, leave, overtime, and shift data into accurate salary inputs while complying with Indian labour laws. It eliminates manual reconciliation and reduces payroll errors.

Is a self attendance app enough for Indian payroll processing?

A self attendance app alone is not sufficient. Without payroll integration, approval workflows, and compliance mapping, it increases the risk of salary discrepancies and statutory non-compliance.

How does attendance impact payroll compliance in India?/h4>

Attendance data determines payable days, overtime eligibility, leave deductions, and wage calculations. Incorrect attendance records can lead to labour disputes and penalties during audits.

What features should Indian HR teams check in 2025?

HR teams should check payroll integration, labour law alignment, leave impact calculations, audit trails, and exception handling before trusting an attendance app.

HCan attendance errors affect employee retention?

Yes. Studies consistently show that payroll inaccuracies — even small ones — significantly reduce employee trust and increase attrition, especially in competitive Indian job markets.